Protect your children’s inheritance from Creditors on Bankruptcy and Insolvency.

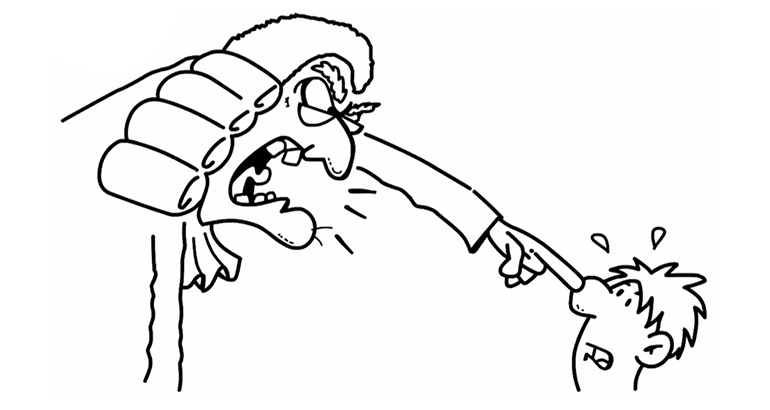

If you gift your assets totally (“absolutely” in legal language) on death, they become the full property of the beneficiaries. This means that the assets are unprotected and can then be taken or attacked from creditors on bankruptcy or insolvency (such as IVA’s) of your beneficiary.

Your hard-earned money could be wasted and lost from your family.

For example; a beneficiary could use your legacy to help start a business, an admirable thing to do, but not easy – some 80% of all new businesses fail. The new business could run into financial issues resulting in a loan being called in and the business closing.

Or perhaps your beneficiary is simply not ready to manage their inheritance and spends freely, running up credit card bills and short-term loans.

Either way, they could run into claims attacking your hard-earned legacy – from county court claims to bankruptcy suits or IVA’s – not really what you imagined your money would be used for.

By setting up a simple Trust with your Will, you could help protect that money from courts, meaning your children and even grandchildren could enjoy their inheritance from your estate for years to come.

Protect your children’s inheritance from Creditors on Bankruptcy and Insolvency. Contact us today.

This video explains:

Relevant links: